Forex For The Week of March 3, 2014 – Rope A Dope

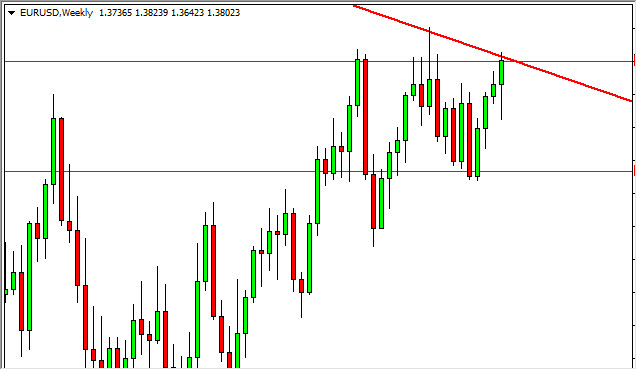

The Forex markets really showed up towards the end of the week – flashing a few flamboyant moves. Friday was especially interesting, as we are now looking at a possible move much higher in the EUR/USD pair. However, there is a lot to “chew on” before the Euro can claim victory, and the area just above the current line trend line is vital to say the least.

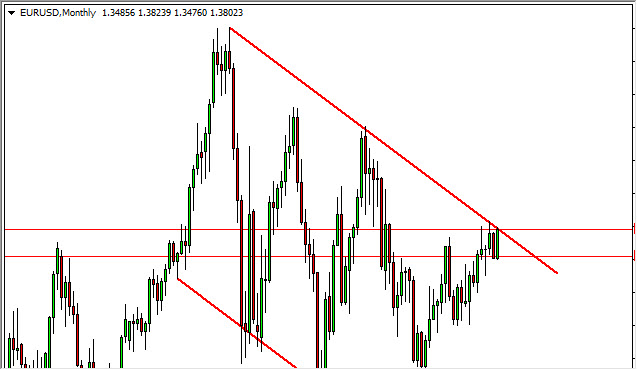

The EUR/USD pair has been in a down trending channel for some time now, basically since the 2008 financial crisis. The market has faithfully obeyed this line as the market has fallen each time, but the weekly candle forming a hammer just below the line suggests that perhaps we could finally break out of this channel. If this happens – look out, the Euro could be massively bullish for the longer-term.

As a result, we are very interested in this pair. The market will be dangerous in the meantime, and because of this we are staying out for the time being. However, we are interested in seeing what the next weekly candle shows us. The move above the trend line would signal a longer-term bull run. However, we could also see a pullback of significant proportions.

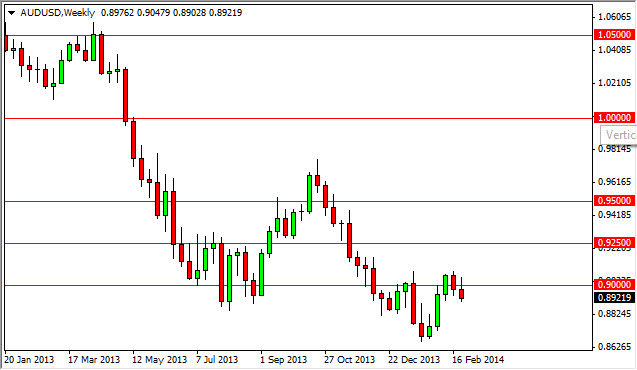

Looking at the AUD/USD, we can see that the weekly candle ended up printing a shooting star at the 0.90 level. The area looks as if the market is ready to start falling again, and because of this, we feel that this currency should fall to fresh new lows given enough time. The gold market had been going higher recently, but the Aussie sat still. Because of this, we feel that the inherent weakness is a strong sign of bearishness. The Aussie obviously has problems, and we think that it should be sold. Not only against the USD, but most non-commodity currencies as well.

Continuing the theme of commodity currency weakness, we have the New Zealand dollar. The NZD/USD pair rallied on Friday, but found the all-important 0.84 level to be far too resistive, forming a shooting star. Because of this, we feel the NZD is about to pullback in the next few sessions.

This week:

sunday – China HSBC Final Manufacturing.

monday – AUD Cash Rate and RBA Statement.

tuesday – UK Construction PMI

wednesday – CAD Overnight Rate and BoC Statement

thursday – UK Official Bank Rate and MPC Statement

friday – USA Non-Farm Payroll, Canada Employment Change