Forex for the week of June 9, 2014

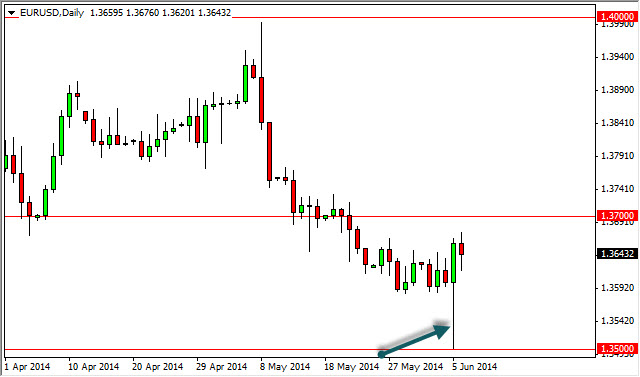

The forex markets got the answer on Non-Farm Payrolls this week, as well as the decision by the ECB. At the end of the week, it was a bit surprising that the markets didn't really make new ground in a lot of the pairs. One obvious place was the EUR/USD pair, where the Euro was pounded by the negative real interest rate decision by the ECB, only to turn things around at the all-important 1.35 support area. This level is the absolute bottom of the potential “summer range” that we have been following, and now that it has held up in the end, we think the market will more than likely spend the summer above that level.

Looking at the EUR/USD daily chart below, you can see that the 1.35 level acted as an absolute “brick wall” for the sellers, and big money must have flown into the markets at that point. The massive hammer that formed tells us that the EUR/USD pair will continue to be a “buy on the dips” type of market.

That being said, the 1.37 level seems to be “fair value” at the moment, with the 1.40 level being “too rich.”

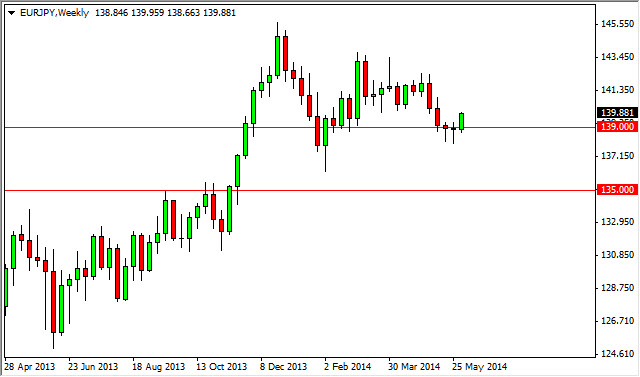

Another chart that we really, really like at the moment is the EUR/JPY pair. Looking at the weekly chart in last week's analysis, we noted that there were two hammers in a row. The action that we saw in the Euro this week only confirmed the support for the currency, and the break above those two hammers suggest that the market should continue to go higher. We are looking for a move to the 143.50 level first, and then perhaps as high as 145 this summer.

All things being equal, we think the Euro should do fairly well this week, but also recognize that the EUR/JPY pair might be the easier choice to trade.

This week:

Mon – China Trade Balance

Tues – China CPI, UK Manufacturing Production

Weds – UK Employment Figures

Thurs – USA Retail Sales and Unemployment Claims

Fri – BoJ Press Conference and USA PPI