Forex for the Week of May 26, 2014

The Forex markets saw the continuing of Euro weakness over the course of the past week, and on Friday we saw the EUR/USD pair test the 1.36 level. This area opens the door to the 1.35 level, and massive support. Because of this, although we are bearish at the moment, we recognize that the downside might be getting a bit limited at this point in time. The European Central Bank of course will continue to push for a lower level, but in the end nobody knows how to devalue like the Fed, and therefore we think that this pair will remain somewhat afloat over the summer.

Speaking of summer, the pair looks as if the range is probably being defined at the moment. The summer months tend to be relatively quiet in the currency markets, and typically we see a drop in action, and a range is quite typical. Right now, it appears that this pair could be caught between the 1.35 level and the 1.40 handle for the summer. That being said, if the 1.35 gets broken to the downside – this market gets ugly quick, and the sell off could be brutal.

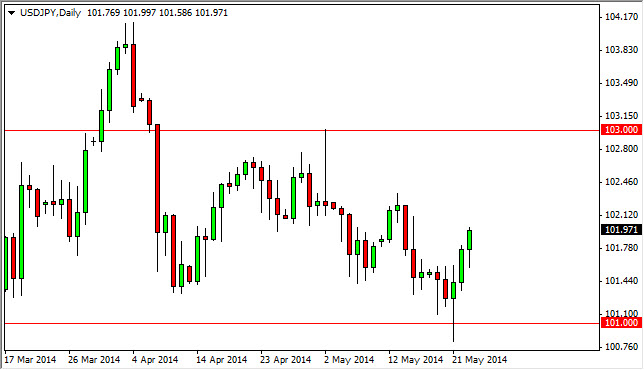

The USD/JPY pair looks as if it is going to be range bound as well, as the 101 level continues to offer a lot of support going forward. The market seems to have a ceiling at 103 also, so this looks as if it is the “safe bet” for the summer range. With this, we feel that trading the short-term charts could be the answer to the pair for the next couple of months. The breaking of 103 is expected, but we don't think it will be in the near-term. We believe that the move above there should be relatively strong, but in the end – the 105 level is calling.

The markets look ready to take a break in general, and as a result we will be looking to the short-term charts for inspiration. However, we feel that ultimately the “risk on” rally should continue into the second half of 2014.

This week:

Mon – NZ Trade Balance

Tues – US Core Durable Orders

Thurs – US Prelim GDP, US Unemployment Claims

Fri – Canada GDP

Sat – China Manufacturing PMI