Forex for the week of May 12, 2014

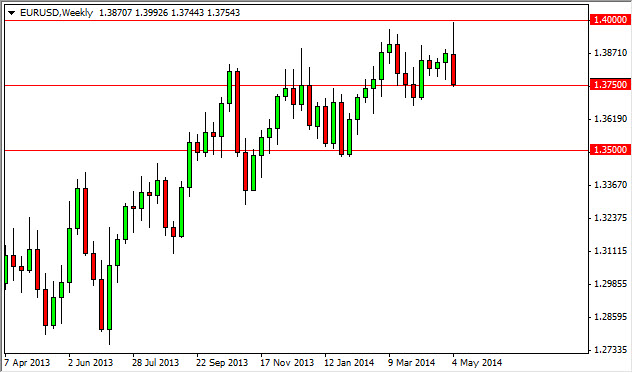

The Forex markets focused on the European Central Bank and its intentions this week, as the Euro has been a currency that has been very strong while the ECB hasn't liked the attention. Truthfully, the market has shown the 1.40 level is one that will continue to be a lot of trouble. The market saw a lot of negativity after the ECB suggested that the central bank could in fact act against the strength if need in June, and this sent the Euro tumbling against most currencies. The most obvious market was the EUR/USD pair, which is of course the most highly traded financial market on earth. As you can see, we essentially closed at the bottom of the range for the week.

As you can see, the market fell hard. The 1.3750 level is supportive, but we feel that the market will be attracted to the 1.35 level as well. However, there is the possibility that we will bounce in the short-term. This is the possible path that we will take, but we cannot believe that the market won't sell off every time the market gets near the 1.40 level. This should continue going forward, and probably going to be so during the summer months as liquidity will more than likely dry up for a while.

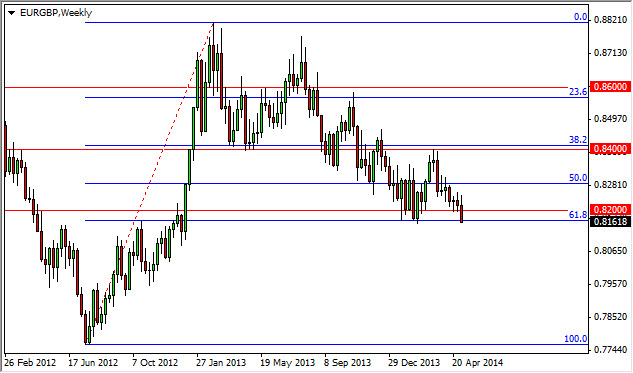

The EUR/GBP pair also pulled back drastically, and now sits on top of the 61.8% Fibonacci retrace level. This also is an area that has seen supportive action in the past. The 0.8150 level could possibly offer supportive action, however – we feel that Euro will continue to struggle in general, and as a result the market should break down from here. This could lead to the 0.80 level as it is the real support in this market longer-term.

Because of these two charts, we feel that the market will more than likely offer selling opportunities as the weakness could be a bit longer-term in general. The Euro is in trouble everywhere it seems, and this is going to be especially true in some of the more exotic pairs.

This week:

Mon – AUD Business Confidence

Tue – China Industrial Production, German ZEW, USA Core Retail Sales

Weds – UK Claimant Count Change, UK Inflation Report, USA PPI

Thurs – USA Core CPI, USA Unemployment Claims

Fri – USA Univ. of Michigan Consumer Sentiment