Forex for the Week of June 16, 2014

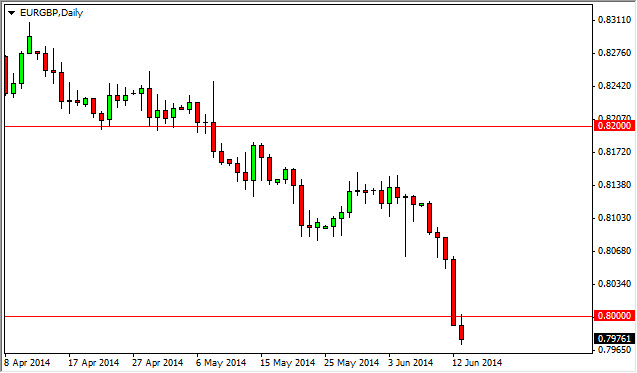

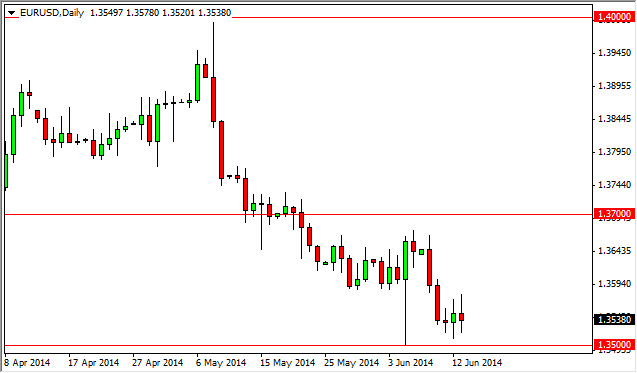

The Forex markets continue to look very Euro-negative, as the EUR/USD and EUR/JPY pairs are pushing against the major support areas we have been watching for some time. The EUR/GBP has actually broken below the vital 0.80 level, so it appears the Euro will more than likely be tested this coming week. Because of this, we believe that the Euro is what we need to watch overall. The markets will more than likely try to make a significant move, but there is still the threat that some of the pairs will stay range bound, and as a result we think this week could be very important.

This is also true due to the fact that the summer is approaching, and as a result there will more than likely be a lack of liquidity out there, and the markets will soon get very range bound for a few months – if history shows us anything. Of course, there is the possibility that something happens over the summer to move the markets, but in general we aren't looking for anything major at this point.

As you can see, the EUR/GBP has not only broke below the 0.80 level, but has also bounced in order to check the level for resistance as well. With this, we suspect that the market will continue going lower, and the Euro in general could suffer. However, the Pound is also very strong, so to play Euro weakness, it might be best to be short of this pair.

The EUR/JPY pair tested the 138 level, and as a result the market looks as if it is going to break down below the support level in order to break down even further. The 135 level below will be targeted if we continued lower. The breaking of the top of the two shooting stars over the last 48 hours would be a buying opportunity as well, as the market should return to the 140 level.

Looking at the EUR/USD pair, we can see that the 1.35 level is supportive. The area being broken down would send this pair to the 1.33 level over time, and perhaps even lower than that. However, if we break higher, we could find ourselves bouncing between that area and the 1.37 level. This could in fact be the summer range if nothing gets going.

This week:

Mon – Australian Monetary Policy Meeting Minutes

Tues – UK CPI q/q, USA Core CPI m/m

Weds – UK Bank Rate Votes, NZD GDP q/q, USA FMOC Press Conference

Thurs – Swiss Libor Rate, SNB Monetary Policy, SNB Press Conference, USA Unemployment Claims

Fri – Canada Core CPI m/m